Land value taxes are once again becoming a popular all-purpose solution to housing issues. But implementing them in early 1900s Britain destroyed the then-dominant Liberal Party.

In the late nineteenth century, the ideas of American economist Henry George were popular around the English-speaking world. His best-known work, Progress and Poverty, examined the importance of land in economics and proposed taxing land value as much as possible. It sold several million copies and was one of the best-selling books of its era.

Across the Atlantic from George, the wealthy landowners who dominated British politics predominantly supported the Conservative Party. In response, their opponents, the Liberals and Irish nationalists, increasingly harnessed tenant agitation for political support and with it, support for land taxation.

Subscribe for $100 to receive six beautiful issues per year.

George’s argument was perfectly timed for the Edwardian left. Local government was in crisis as new infrastructure enabled people to move out of the city center while budgets were burdened with ever more statutory obligations. The existing property tax base could not be managed. By the early 1900s, Progress and Poverty was more popular than Shakespeare among Labour MPs. In 1910, the Liberal government of Henry Asquith implemented a tax on increases in land value and undeveloped land with a view to reforming Britain’s system of property taxes.

Asquith’s gambit failed spectacularly. Britain in the early 1900s became a case study in how administrative complexity can derail land value taxation. The tax cost more to administer than it collected, and it was so poorly worded that it ended up becoming a tax on builders’ profits, leading to a crash in the building industry. As a result, David Lloyd George, the man who introduced the taxes as chancellor in 1910, repealed them as prime minister in 1922. The UK has never fully reestablished a working property tax system.

This history serves as a cautionary tale for modern Georgist sympathizers who believe a land value tax will solve the world’s housing shortages. While Georgists argue that land markets suffer from inefficient speculation and hoarding, Britain’s experience reveals more fundamental challenges with both land value taxes and the Georgist worldview. The definition of land value was impossible to ascertain properly and became bogged down in court cases. When it could be collected, it proved so difficult to implement that administration costs were four times greater than the actual tax income. Instead of increasing the efficiency of land use, it became a punitive tax on housebuilders, cratering housing production.

Worst of all, it not only failed to solve the fundamental problem with British local government – that it had responsibilities that it could not afford to cover with its narrow base – but actually contributed to the long-term crumbling of the property tax systems Britain did have.

Not all countries failed as spectacularly as Britain, dooming not only the land value tax itself but also the existing property tax system it replaced, but few countries have successfully implemented a land value tax. Most countries that claim to have land value taxes, like Australia and Taiwan, exempt the two biggest uses of land: agriculture and owner-occupied housing.

How Liberals came to love land value taxes

By 1900, 77 percent of Britain’s population lived in cities, and around two thirds of men (but no women) could vote after three Great Reform Acts of 1832, 1867, and 1884. Still, a relatively small number of landowners continued to wield outsized influence in politics. In 1880, 322 of the 652 MPs owned more than 2,000 acres. The House of Lords, which possessed the power to veto all legislation (although by centuries-old convention, it had typically given way when the two houses disagreed), was even more landowner dominated, with 308 of its roughly 800 members being among the 6,000 largest landowners in England.

Henry George had long maintained an interest in Irish affairs. Despite being an evangelical Protestant of English ancestry, he had in 1869 edited a small Catholic weekly newspaper called The Monitor. Later, in 1879, he argued, for the Sacramento Bee, that the landlords of Ireland should be expropriated to lift the burden of rents on farmers. He sent 25 copies of his most famous book, Progress and Poverty, published that same year (but mostly ignored until later), to leading Irish-Americans in New York. One of them, George Ford, was the founder and editor of Irish World,the largest Irish-American paper at the time, for which George regularly wrote.

In October 1881, Henry George arrived in Cork in Ireland, then part of the UK, tasked with covering a country in uproar for Irish World. Land issues were central to the turmoil. In 1879, the Irish nationalist MP Charles Stewart Parnell and Michael Davitt, the leader of Ireland’s land reform movement, together advocated for forcibly transferring the country’s land from wealthy Protestant landlords to their poorer, mostly Catholic farmers, mobilizing tens of thousands of tenant farmers in a campaign of mass agitation against landlords known as ‘the land war’.

George briefly met Parnell, who was then in prison, and developed a working correspondence with Davitt. He used this as an opportunity to spread his message on the need for a land value tax to the rest of the UK, publishing the British edition of Progress and Poverty in 1882 and sending a free copy to every MP. The initial reception in Britain – at that point, the world’s economic and political center – was unenthusiastic. George’s ideas were panned by academics such as Karl Marx and Alfred Marshall and denounced by Liberal MP Samuel Smith as an absurd get-rich-quick scheme like the South Sea Bubble.

But by 1885, the political situation had radically changed. In that year’s elections, Parnell, now referred to as the Uncrowned King of Ireland, led his new Irish Parliamentary Party to win 86 out of 101 seats in Ireland and held the balance of power in Parliament. In 1886, Prime Minister William Gladstone offered him autonomy for Ireland (known as Home Rule) in exchange for his support.

This split the Liberal party. The vast majority of landowning Liberals defected, furious that Gladstone would leave Irish landlords at the mercy of a government led by tenant agitators. A Liberal Unionist bloc allied itself with the anti-Home Rule Conservative Party (and would officially merge with them in 1912). In the 1885 election, 54 of the 111 English constituencies with a significant agricultural population returned a Liberal MP; in 1886 this figure slumped to just 16.

Paying for local government

Following landowners’ mass defection from the Liberals in 1886, the Liberal coalition was able to unite around land value taxation. Land value tax fervor became increasingly dominant on the party’s left and among the grassroots, in part because of its potential as a tool to weaken the power of their political enemies, the large landowners, and in part to fix the growing crisis of local government funding. Starting in 1888, party conference attendees passed successive proposals for land taxation, leading to the inclusion of a land value tax proposal in the Liberal Party’s 1891 Newcastle Programme.

Although Britain already had two property taxes – an income tax, which included rental income, and a property tax with rates for residential and business properties – they appeared to be unable to cover local governments’ obligations.

The first property tax was Schedule A, part of the income tax. At the time, British income tax applied not just to rental income but also to the estimated rental value of houses (aka imputed rent), though only to those earning more than £100, which in 1870 was around 400,000 people out of a population of 26 million. This went to the national government.

The second and more politically significant property tax was ‘the rates’, which went to local governments: domestic rates on residential property and non-domestic rates on business property. (These continue to this day in some form. Domestic rates were abolished in 1990 for the community charge or ‘poll tax’, and then council tax in 1992. Non-domestic rates are now known as business rates.)

British local governments’ remits had expanded with the economy during the Industrial Revolution. Bills enacted in 1848 and 1875 permitted, then mandated, local public health provisions and a basic standard of sewage and water treatment. In 1870, local government was also made to provide compulsory primary education for children between the ages of 5 and 12. As a result, local government spending rose from less than one third of total government expenditure in 1870 to over half in 1905.

Though their remits had expanded, their funds from the central government had not. This put local governments under tremendous pressure. The central government depended upon the income tax, which was sufficient to pay the interest on the national debt, maintain the military, and employ a civil service of 14,000 people. It also paid for approximately one quarter of local spending with government grants. But all of the remaining financing for the extended public services had to come from local taxation.

In 1900, three quarters of funding for local government activities – poverty relief, the police, education, and sanitation – came from taxing rental income. Since urban rents added up to about 10 percent of GDP at the time, this meant that one tenth of the economy was responsible for financing almost the entirety of local authority budgets. Property, and those who occupied or rented it, thus bore the brunt of the tax burden, paying around one third of the nation’s taxes compared to one tenth today.

Relying solely on property taxes might have been fine if local governments had only been responsible for investments that raised local property values. It was not uncommon for private landowners to build infrastructure, establish sanitation services, and run private security for their neighborhoods using the income they made renting out flats or selling leases. This method enabled the initial building and gradual intensification of the central London estates of Mayfair and Fitzrovia. Indeed, many cities around the world today fund their education, sanitation, and infrastructure from locally collected property taxes. In the US, the average state’s property tax revenue is around $2,000 per capita, similar to the revenue raised by local income taxes.

The problem for British local governments in the twentieth century was that they were also responsible for welfare benefits. Wealthier areas could easily afford the necessary taxes to support their small numbers of poorer residents. But poorer areas in the inner cities found this an increasingly difficult burden.

In urban areas, working-class households spent as much as one third of their income on rent. This included approximately seven percent of their income on rates. Meanwhile, upper-class homeowners with incomes of £1,000 or above could expect to pay around seven percent of their income in total on both rents (or mortgages) and rates. Poorer households therefore paid a much higher share of the property tax burden relative to their income.

The situation deteriorated during the 1890s and early 1900s, paradoxically due to a large expansion in the housing supply. The electrification of London’s railways and trams enabled further suburban expansion and a significant increase in housebuilding. Better-off working-class families moved to the suburbs, leaving poorer areas with an even larger relief burden. Rates rose between 30 and 50 percent in all districts of inner London between 1891 and 1901. A typical increase in rates, which was recorded in boroughs like Stepney and Camberwell, was from 6 shillings to 9 shillings per pound. This coincided with a sharp economic downturn beginning in 1905 that caused unemployment in urban areas to skyrocket to double digits, which only increased the pressure on local governments in cities and the ratepayers who supported them.

Paying for local government

After the 1880s, the radical parts of the Liberal Party became increasingly Georgist. The Liberal base comprised nonconformist Christians and business owners, who found George’s message – with its antagonism toward rent but not profit, couched in explicitly Christian terms – extremely persuasive.

Liberal Georgists argued that the root of local government’s problems and poor urban conditions was that taxes were levied on property values, not land values. In part, it was a straightforward economic argument: taxing property meant taxing improvements to land, including building up or replacing dilapidated housing stock, which disincentivized development. Taxing only land, on the other hand, would not discourage improvement. Progressive members of cash-strapped councils like London and Glasgow supported land value taxation on top of property taxation as a source of extra funds.

But these marginal improvements – reducing the disincentive to improve land and providing more funds for urban councils – were only part of the reason Liberal Georgists favored land value taxation. George had promised his followers nothing short of Utopia. George argued that since all production needs land, competition would push labor and capital returns down to minimum levels, leaving all remaining economic surplus to accumulate as land rent. Therefore, he concluded taxing land rent alone could fund all government activities since it captured society’s total surplus value.

Intercepting this entire social surplus with the land value tax, he argued, would provide not just all the money the government needed but enough to end poverty and create a harmonious society in which all humans could fully satisfy their innate needs and desires.

As we have seen, George’s dedicated Liberal followers lobbied for decades to convince others in the party to implement the tax – and it worked. By the 1906 election, 68 percent of English Liberal candidates endorsed land reform, and 52 percent of English liberal candidates mentioned land value taxation in their campaign manifestos. The loss of landowners, local governments in crisis, and Georgist ideology had together driven land value taxation to the center of the Liberal platform.

Tories ride a wave of ratepayer revolts

In 1903, the Conservative government of Arthur Balfour imploded over its handling of the Boer War, including public revulsion at its use of concentration camps, and colonial secretary Joseph Chamberlain’s resignation to begin a campaign of tariff reform. Chamberlain had demanded that Balfour impose tariffs on goods imported from outside the British Empire to shield industry from growing foreign competition. When Balfour refused, the resulting split fatally weakened the Conservative Party.

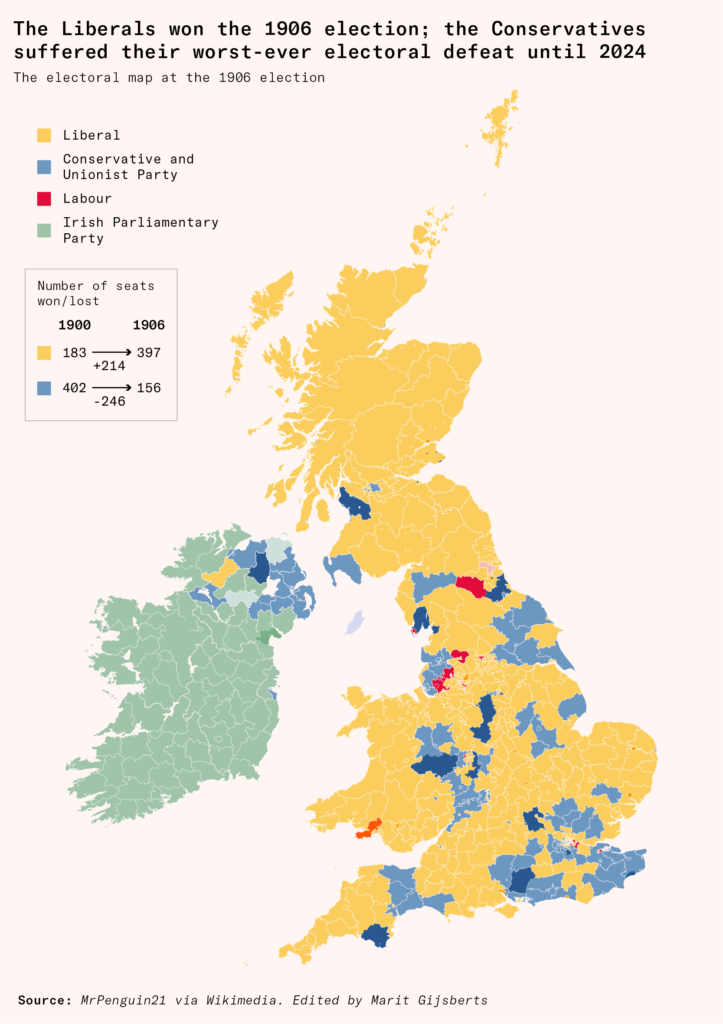

The Liberals, now unified in their support of land value taxation, won the 1906 election. The Conservatives suffered their worst-ever electoral defeat (until 2024), with the number of Conservative Members of Parliament falling to 156. The Liberals now held a large majority in the House of Commons.

Still, opponents of land value taxation abounded. While the largest landowners in the House of Lords were unlikely to elicit broad public sympathy on their own, the million or so smaller property owners, including shopkeepers and landlords of working-class housing, were a different matter. Most landlords and shopkeepers outside of London were freeholders, and even those who did lease land often did so with 100-year leases, usually on terms that meant that they paid all taxes (despite not being the freeholders). As a result, they believed that they would ultimately have to contribute the bulk of any land value taxation.

For landowners, taxing ‘excess’ land rent from profitable investments made as little sense as compensating them for losses. From their perspective, any ‘land rent’ was the reward for taking risks and investing personal savings in the uncertain and heavily taxed urban property market. The rates were already too high, in their view, and they saw the prospect of paying a land value tax at even higher rates as an unacceptable burden.

This coalition proved a formidable political force, which the Conservatives actively courted. Following their 1906 defeat, the remaining Tory MPs pressured Balfour to make both new tariffs on imports and the extension of national welfare programs central to Conservative policy. Tariffs, which implied a source of revenue to relieve the burden of rates, won the Conservatives support in local elections from disgruntled ratepayers.

Local Conservatives capitalized on these ‘ratepayer revolts’ to end the progressive parties’ dominance of local politics (including both Liberals and the nascent Labour party). The London borough elections of 1906 and the London County Council in 1907 both returned majorities for the Municipal Reform Party, which was closely allied with the Conservatives. At a national level, the resurgent Conservatives triumphed in eight by-elections between January and September 1908.

The new Liberal government was thrown into crisis. Prime Minister Henry Cambell Bannerman resigned on health grounds and his successor, Herbert Asquith, decided that significant welfare reform was necessary to counteract the Conservatives’ newfound appeal.

Liberals shift toward tax and spend

The Liberals had traditionally been the party of low taxation and low central government spending. Apart from the military and empire, they believed that public services could – and should – rely on the rents from local land. The traditional argument was that funding from the central government represented ‘doles for squire and parson’, subsidizing the Tory-voting landlords who paid the rates while encouraging profligate spending by local governments.

The new Conservative challenge forced the Liberals to change their stance. In 1908, the government introduced state-funded old-age pensions and prepared to introduce unemployment and health insurance. But it was unclear how they would fund this nascent welfare state. Meanwhile, the government also needed money to fund a naval arms race with Germany.

Chancellor David Lloyd George saw an opportunity to tax the Conservative voter base as much as possible. In his 1909 budget, Lloyd George proposed two major tax reforms. The first increased income taxes for high earners. The second introduced three new land taxes, the first new land taxes in Britain since the 1700s: an annual 2.5 percent tax on undeveloped building land, a five percent annual surtax on mining royalties, and a 20 percent capital gains tax on land transfer, known as an increment duty. The taxes were designed with the intention that shopkeepers and landlords of working-class housing were not affected. Owner occupiers were also exempted from the new increment duty.

There was just one problem: since the Liberals had lost the support of large landowners in 1886 (who had broken away to become the Liberal Unionists), their share of the House of Lords had fallen from 41 percent to seven. And the upper chamber still had the legal power to block legislation, although a convention dating back to the 1600s held that the veto power should not be used to block finance bills.

The Lords found themselves unable to obey the centuries-old convention. It made the unprecedented decision to veto the budget, committing to passing it only if the Liberals won another majority.

This prompted a constitutional crisis on the best possible terms for the Liberal Party. They called a new election to obtain a mandate to pass the budget, which they declared one of ‘Peers versus the People’, arguing that unelected Lords wished to replace the Liberal People’s Budget with regressive tariffs, including on basic foodstuffs.

Despite this Liberal advantage – that the Tory Lords had effectively violated the constitution of over 200 years – the resulting election of February 1910 was closely fought. Conservative tariffs were popular in areas threatened by emerging competition from Germany and America. The propertied classes and agricultural interests rallied. In the end, the Liberals won two more seats than the Conservatives, but the Conservatives won three percent more of the vote – a 5.4 percentage point swing away from the Liberals. The Liberals managed to form a majority with the support of the Labour Party and the Irish Nationalists.

Implementation proves difficult for land value taxation

After winning the election, the Liberals passed their finance bill, enacting the new land value taxes. They then held another election to strip the House of Lords of its veto power, which resulted in another close electoral victory and enabled the party to pass the Parliament Act in 1911.

The old property taxes had been simple: tax was based either on the actual rent a property went for or on what the local authority judged a property to be worth based on similar properties nearby. But the new land taxes proved exceedingly difficult to calculate. In theory, the fact that many property owners, like people who owned the homes they lived in (owner-occupiers), were not expected to pay them might have muted this problem. But the government decided to calculate a full set of property values anyway to make future changes to the legislation easier.

The tax on mining royalties was easy enough: it was just an additional tax on the revenue a landowner received from a mining company. But the other two taxes involved complex calculations. The 20 percent tax on unrealized increases to property values, which applied to agricultural, industrial, and residential land, required the government to establish a baseline price for the land against which increases could be judged. This was doubly true for undeveloped building land, which also faced the 2.5 percent annual tax.

There were close to ten million properties in the country that needed valuing, and for the majority of these properties, the land and structure had been traded together, meaning that there was no distinct market valuation of land to draw from. What’s more, in line with Georgist theory, the tax was supposed to credit owners for improvements they made to the land. But this meant calculating several hypotheticals, many of which had never been measured or recorded, including building and structure value and value contributed from plumbing, access to railways, and other infrastructure contributions.

The process was beyond the capacity of the government. In August 1910, the Liberals sent out 10.5 million copies of the notorious ‘Form 4’, which required owners to submit specific details on their income and the use and tenure of their properties. It also required them to estimate the site value themselves. Failure to return the document carried a fine of £50, about £7,500 in current prices.

Landowners formed an organization known as the Land Union, which began a program of high-profile legal attrition – subjecting every ambiguity of the law to judicial review – to test the complex and hurriedly made legislation in the courts. The campaign was successful, eventually resulting in the Scrutton judgment of February 1914, which invalidated all valuations of agricultural land – effectively blocking the 2.5 percent tax on undeveloped land and the collection of the increment tax as it applied to farmland.

A common Georgist view was that property speculators hoard urban land, and land taxes would force them to develop it. In practice, the exact opposite happened. The additional taxes simply reduced builders’ profits and forced many to reduce production. The new taxes also devalued building land, leaving housebuilders with devalued collateral for their loans, which threatened to bankrupt many of them. As a result, instead of rising, building rates cratered, falling from 100,000 in 1909 to 61,000 in 1912.

Land taxes raise less than the cost of implementation

The land taxes did nothing to solve the critical issue of financing local governments. Liberal Georgists had suggested using the revenue from these taxes (which went to the central government as opposed to local authorities) to dole out grants to cities. But by 1914, the failed valuation schemes had cost £2 million to implement, while the taxes had brought in only £500,000. The government had lost money while damaging the urban economy. There was nothing left for cash-strapped local governments. Grants to local authorities increased by just two percent between 1908 and 1913, while spending grew by 18 percent.

By 1913, local governments across the UK were in crisis. There were warnings from local government associations that the education system was on the verge of collapse. The Association of Municipal Councils went so far as to accuse the chancellor of ‘having jeopardized the whole of the local government of England’.

Lloyd George finally made a public commitment to rating reform in February 1914, announcing that the local rates would move from a tax on property to a tax solely on land value paid to the local government. This would finally achieve the goal of the Liberal Georgists. The full weight of the rates would, allegedly, fall upon the landowner rather than the labor or capital. We have already seen how this assumption was questionable. But ultimately whether they were theoretically right was irrelevant. The program was impossible to implement quickly: the Valuation Office predicted that it would take until 1917 to finish the valuation at the earliest.

In the end, the outbreak of the First World War put the final nail in the land value tax coffin. In 1916, Asquith was replaced as prime minister by David Lloyd George, and the Liberal party split, with Lloyd George leading a coalition between the Conservatives and Liberal MPs loyal to him until 1922. The Conservatives were still opposed to the land value taxes and Lloyd George was not prepared to defend their continuation given their abject failure before the war. The valuation, frozen during the war, was formally ended in 1920, and the remaining land taxes were abolished by Lloyd George himself in 1922.

What we can learn

The land value tax debacle teaches us that local government cannot perform its function of investing in local public goods – infrastructure, sanitation, and so on – if it neither has the base to fund it nor the incentives to carry it out. Before the First World War, the British local government was a powerful part of the growth coalition. In the 1890s and 1900s, British councils borrowed money from private firms to build tram, electricity, and gas networks, paying off the loans primarily through new tax revenue generated from the resulting local economic growth. By 1910, London County Council alone had built 120 miles of electric tram routes.

Yet there was an inherent tension between the demands put on British local governments and the narrow base of taxation they were expected to subsist on. Demands for social services continued to increase throughout the early twentieth century, and two world wars coincided with the continuing expansion of the welfare state. Growing numbers of workers in politically assertive trade unions and universal suffrage (for men in 1918 and women in 1928) reinforced this trend.

Altogether, this meant that Britons were no longer obliged or willing to accept poverty or a ‘postcode lottery’ in local services. Starting in 1929, Britain began redistributing local taxation around the country through a system of ‘block grants’, which gave money from the national taxpayer to needy councils in order to fulfill their social obligations. By 1948, about 30 percent of local government funds came from grants. Today, the share has increased to nearly two thirds.

Local governments began to face high marginal tax rates on any extra income they raised because the more they raised in local tax, the less they got in central subsidy. As a result, British local governments no longer receive sufficient income from new taxpayers to cover the costs of building new housing. This means that local governments in high-demand areas with good jobs have an incentive to restrict development, even though it would be economically beneficial. And national governments, dominated by short-term political pressures, do not allocate enough money for long-term local infrastructure investment. As a result, the UK notably underperforms in its provision of local public goods, from large-scale municipal infrastructure like trams to services like repairing potholes and trash collection.

The second lesson is that the pure land value tax is chimerical. Those countries that raise substantial amounts of tax from land, such as Japan and the USA, do so through taxes on property, as Britain did before David Lloyd George. A pure tax on the unimproved value of land has never been successfully implemented anywhere. Land value taxes introduced in Australia and New Zealand have been repealed. Denmark’s land value tax is a minor quirk of the system, comprising less than two percent of total revenues. The land tax in Taiwan exempts owner-occupied housing and agricultural land – the country’s two main land uses – altogether.

From 1906 to 1914, the Liberals wasted the best chance in British history to put property taxes and local government in the UK on a sound footing for the long run. Their failure left local governments with wide responsibilities but no way to support them except through grants, which have increasingly relied on taxes on income and consumption rather than property. It has been the landowner who has benefited the most.