Americans famously love to sue one another. Are out of control product liability lawsuits the to blame for the crash of the personal aviation industry?

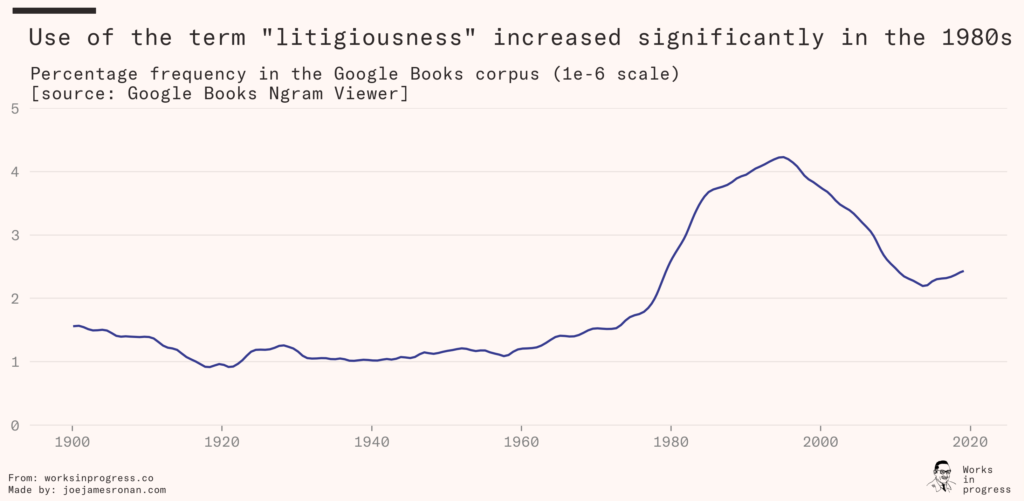

Those of us who remember the 1980s and 1990s likely recall rising concern about America’s ‘culture of litigiousness’, and hand-wringing about what it meant for the country. In Google’s Ngram Viewer book search, for instance, the frequency of litigiousness rises sharply starting in the 1980s.

In Where Is My Flying Car?, J. Storrs Hall makes the case that the collapse of general aviation (a catchall for all noncommercial, nonmilitary aviation) in the US can be blamed on a rising culture of risk aversion, which manifested (among other ways) as a huge increase in lawsuits against manufacturers for injuries or deaths their products allegedly caused:

Subscribe for $100 to receive six beautiful issues per year.

“The 1970s brought an increase in product liability, a major social change that was nominally aimed at safety. Scare stories worked on juries just as well as on the reading public, and juries would vote enormous awards for accidents that didn’t have any reasonable connection to malfeasance on the part of a manufacturer . . . This led directly to the collapse of the general aviation industry. Over the course of the 1970s and 80s, it was strangled by the explosion of product-liability lawsuits.”

Storrs Hall isn’t alone in his disdain for this shift. Product liability lawsuits became emblematic of this problem. No case emphasized this more than Liebeck v. McDonald’s Restaurants, the famous 1994 product liability case where the plaintiff sued McDonald’s, and won, for selling coffee that was too hot. Though the facts of the case make this verdict more reasonable than it first appears (the coffee was 30–40 degrees hotter than competitors, Liebeck suffered third-degree burns and required skin grafts, and hundreds of people had previously complained about the coffee temperature), it nevertheless came to symbolize a culture of frivolous lawsuits, where every harm suffered, no matter how small, demanded legal redress.

How did this situation take root? And how has it developed since? Is product liability still, as Storrs Hall implies, another symptom of a society that has lost its way?

The development of product liability law in the US

For most of the 1800s, the legal doctrine for purchased goods in the US was largely based on the concept of caveat emptor (‘let the buyer beware’) – that, all else being equal, losses should be borne by the person incurring them rather than the producer of the good. Though there were notable exceptions for inherently dangerous items (food and drink, for instance), this doctrine was thought to be well-suited to a country with a frontier being explored, and where risky and potentially dangerous enterprises were crucial for the ‘industrial and commercial development . . . of a new and expanding nation’.

Toward the end of the 1800s, this doctrine began to change. Courts began to recognize that selling a good implied a warranty against latent defects (this is known as merchantability – that selling a product that does X implies that it can, in fact, actually be used for that purpose). This doctrine spread throughout the states in the late 1800s, and eventually was adopted nationally in the form of the Uniform Sales Act of 1906 (later succeeded by the Uniform Commercial Code). However, outside of a few exceptions (‘imminently dangerous’ items such as foods, explosives, and poisons), this warranty existed as a matter of contract between the buyer and the seller. If you didn’t purchase your good from the manufacturer, you had no contract with them, and thus couldn’t sue them if something went wrong with it (this is known as privity of contract). This meant that if a manufacturer sold their goods through a reseller, or if someone other than the purchaser was harmed by a product failure, there was no legal recourse against the manufacturer if the product failed.

The case marking the beginning of a change in this doctrine was MacPherson v. Buick Motor Co. In 1911, Donald MacPherson was driving a Buick he had recently purchased when the spokes on a rear wheel collapsed, causing it to crash. The case eventually reached the New York Court of Appeals, where the court, finding for MacPherson, ruled that ‘imminently dangerous’ wasn’t limited to just foods, poisons, and explosives. The court held that ‘If the nature of a thing is such that it is reasonably certain to place life and limb in peril when negligently made, it is then a thing of danger’ – if the manufacturer knows that it ‘will be used by persons other than the purchaser, and used without new tests, then, irrespective of contract, the manufacturer of this thing of danger is under a duty to make it carefully’. Over the following decades, this interpretation began to spread throughout the states, with courts finding manufacturers liable for faulty cosmetics, hair dyes, and other similarly ‘dangerous’ products.

The next major shift in liability doctrine was the shift toward strict liability. First articulated in the 1944 concurring opinion for Escola v. Coca-Cola Bottling Co. (where a woman was injured when a glass bottle of Coke exploded in her hand), this transition was marked by the 1963 California case Greenman v. Yuba Power Products, Inc. The plaintiff was injured when a power tool he had purchased malfunctioned. In finding for the plaintiff, the California Supreme Court held that ‘a manufacturer is strictly liable in tort when an article he places on the market, knowing that it is to be used without inspection for defects, proves to have a defect that causes injury to a human being’. In other words, even in the absence of ill-intent, or negligence, or a contract, the manufacturer was responsible for injury caused by their product simply by virtue of having made the product and put it on the market.

Under strict liability, all that’s required for a manufacturer to be liable for harm caused by their products is for a product to be found ‘defective’, with ‘defect’ encompassing both manufacturing and design issuesdefects, as well as failing to warn users of potential hazards. This notion of strict liability marked a major change in legal doctrine – the shift toward it was described in a soon-to-be famous 1960 article by legal scholar William Prosser as an ‘Assault Upon the Citadel’ (which then became ‘The Fall of the Citadel’ in his follow-up article six years later.) This interpretation of strict liability spread rapidly through the states in the 1960s and 1970s, and became the foundation for the later surge in product liability litigation.

Changing doctrine, changing culture

What was the origin of this evolution of legal doctrine? While not diagnosing it specifically, Storrs Hall paints a picture of a society of self-reliant individualists giving way to one where problems and risks are best managed by a powerful, overarching state:

“It is difficult to overstate how much the American experience in World War II shaped the culture and the institutions of not only the postwar world (and its expectations for flying cars) but the Great Stagnation and the graveyard of dreams. The individualistic and self-reliant culture of the 19th century had been winding down as the frontier filled up, but it gave way with a bang as Americans arose ‘in their righteous might’ to prosecute the war – under a completely centralized bureaucratic government structure. This was obvious not only in organizing the military but in planning civilian production on an unprecedented scale. We came into the postwar world with the belief that such a structure worked. After all, it had not only won the war but left the US the preeminent industrial power in the world.”

And indeed, the postwar world was one where all levels of government began to take a more active role in addressing what they saw as important social problems. Starting in the 1960s, for instance, the federal government greatly increased the amount of legislation it passed and programs it established. From Gary T. Schwartz’s ‘The Beginning and End of the Rise of American Tort Law’:

Between 1964 and 1968, Congress produced new legislation at an historic rate. The Civil Rights Act was passed in 1964, prohibiting discrimination in employment and public accommodations; it was followed by such measures as the Fair Housing Act of 1968. Serious problems of persistent poverty in America were discovered, leading to the declaration of a war on poverty, a war that was implemented along several fronts. The . . . Department of Housing and Urban Development was created not only to coordinate existing federal programs but also to develop for the first time a federal urban policy. A Department of Transportation was also established and charged with the responsibility of thinking through a national transportation policy . . .

The establishment of new programs continued into the Nixon administration. In 1970, it was President Nixon who, without evident discomfort, signed the Clean Air Act Amendments and Occupational Safety and Health Act. Indeed, more new federal agencies were created during the Nixon administration than had been created during the administration of Franklin Roosevelt.

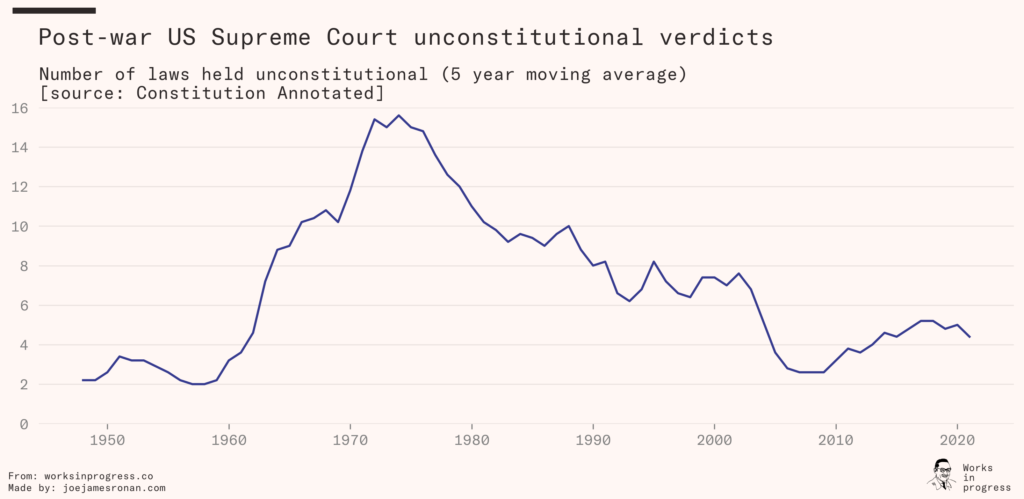

A similar shift took place on the Supreme Court, where beginning in the 1960s we see a major increase in the number of laws found unconstitutional.

This was the era of the Warren court, where the Supreme Court was envisioned as something that could take a more active role in shaping the country, that could ‘intervene when American democracy was not truly democratic’. Between 1953 and 1969, the Warren court (in what would come to be known as ‘judicial activism’) handed down a series of landmark decisions aimed squarely at social reform, ranging from racial desegregation to criminal defendants rights, to free speech. As described by Robert G. McCloskey in the 1965 article ‘Reflections on the Warren Court’:

“In the last dozen years the Justices have written a spectacular new chapter in the history of constitutional law relating to individual rights . . . It is the drama of their civil liberties crusade that has captured the public mind . . . and . . . provoked a new torrent of controversy and speculation about the ‘role’ of the Supreme Court.”

Similar changes were at work elsewhere. State and local governments saw an influx of activist governors, mayors, and other officials, many of them graduates from public policy university programs. At the same time, the climate in law schools was shifting away from the traditional view of lawsuits as a ‘necessary evil’, toward one where lawsuits were an important assertion of rights.

The shift in liability legal doctrine followed this trend. Between 1900 and the late 1950s, American tort law (which encompasses all civil harms, including product liability) was largely stable and mostly clarified existing doctrines. This stability was upended with the shift toward strict liability in the 1960s and 1970s.

The intent behind this effort was, in part, a deliberate attempt to improve social welfare by using liability law to create what amounted to a kind of mandatory accident insurance. The rationale (known as ‘risk spreading’) was that manufacturers would absorb the costs of product safety (by making changes that would make products safer), which would then be passed on to the consumer. Consumers, in essence, would be paying slightly higher costs across the board, but individuals would be shielded from shouldering what might be extremely high costs (injuries or deaths) from product failure.

Beyond this rationale, there was also a perception that manufacturers and consumers were on an increasingly uneven playing field with regard to modern technology. The previous decades had made common things such as television, cars, jet travel, and any other number of gadgets that people used ‘without having the slightest conception of how most of them function’. The increasing technical complexity of consumer products meant that it was less and less possible for consumers to understand how the products they were buying worked. Manufacturers, on the other hand, having built and designed the products, possessed all the expertise about them. Therefore, it was only reasonable that manufacturers bear more of the responsibility if using a product resulted in harm.

In Searching for Safety, Aaron Wildavsky notes there are two broad strategies for managing risk – trial and error, and trial without error. Trial and error is a strategy of resilience – of responding effectively to risks once they’ve occurred. Trial without error, on the other hand, is a strategy of anticipation – of trying to predict risks and prevent them from occurring in the first place. One way of thinking about the shift in liability doctrine over the twentieth century is as a shift away from trial and error (redressing harms once they’ve occurred) toward trial without error. By making manufacturers responsible for any type of product failure, it forced them to try to anticipate in advance everything that might go wrong with a product.

The liability explosion

As the doctrine of strict liability gained acceptance in the late 1960s and early 1970s, it was followed by what has been described as ‘an explosion of tort liability’ cases, including product liability litigation. Between 1974 and 1985, there was a 758 percent increase in the number of product liability cases filed in federal court, and the average jury award in product liability cases more than tripled. Mass tort lawsuits, ultimately involving hundreds of thousands of claims, began to be filed against products found to be dangerous, such as asbestos, Agent Orange, the Dalkon Shield, and Bendectin.

(Experts disagree whether the rise in product liability cases was an across-the-board increase, or concentrated in a small number of products that had huge numbers of claims filed – by 1987, for instance, asbestos cases made up 50 percent of all federal product liability cases. But in terms of expected cost, it’s not necessarily much different: In the former, a company faces a small risk of a large payout; in the latter, it faces a very small risk of a catastrophic, company-destroying payout.)

This rise in litigation was aided by changes in the rules surrounding the practice of law. Walter Olson, in his appropriately titled book The Litigation Explosion, notes that over the course of the twentieth century lawyers had gained the ability to advertise their services, accept contingency fees, and ‘district shop’ (choose, to some extent, where a case was tried). Class action lawsuits had become easier to file, and rules around pleading (requirements for the specificity of the accusation) and accepting evidence were both loosened. Taken together, these changes lowered the barriers to filing a lawsuit, and increased the expected value for filing one (particularly for the lawyer trying the case).

This rise in liability litigation caused, at least in part, an enormous rise in liability insurance costs. A wide variety of businesses and organizations saw enormous increases in liability insurance premiums in the mid 1980s. Municipalities saw their insurance premiums increase by 100 to 1,000 percent in 1985. The City of Los Angeles’s transit provider annual premiums rise from $67,000 to $1.7 million. Grocers saw liability premiums increase up to 500 percent. Architects and engineers saw 200–300 percent increases. Forty percent of day cares canceled their insurance, with the remaining ones seeing 200–300 percent increases. Appliance manufacturers, toy makers, nurse midwives, newspaper and magazine publishers, and banks were also affected.

(Beyond the increase in tort litigation, there were other factors at work behind the rise in liability insurance costs, such as falling interest rates, which changed insurers’ investment calculus. But there seems to be little doubt that rising costs from litigation was a major factor.)

General aviation became a casualty of this new liability environment. Per Storrs Hall, ‘[Product liability] led directly to the collapse of the general aviation industry. Over the course of the 1970s and ’80s it was strangled by the explosion of product-liability lawsuits.’

In 1977, the general aviation industry paid out $24 million in liability claims. By 1985 that had risen to more than $200 million. The cost of liability insurance followed suit (though it often didn’t follow fast enough – in 1982, for instance, insurance paid out more than 20 times in claims than they received in premiums for aircraft bodily injury). The General Aviation Manufacturers Association (GAMA) reported that the cost of liability insurance in 1962 was $51 per plane delivered. By 1985, it had risen to $70,000 per plane ($19,646 in 1962 dollars) or more. Many insurers retreated from the general aviation market – Lloyd’s of London, for instance, stated, ‘We are quite prepared to insure the risks of aviation, but not the risks of the American legal system.’

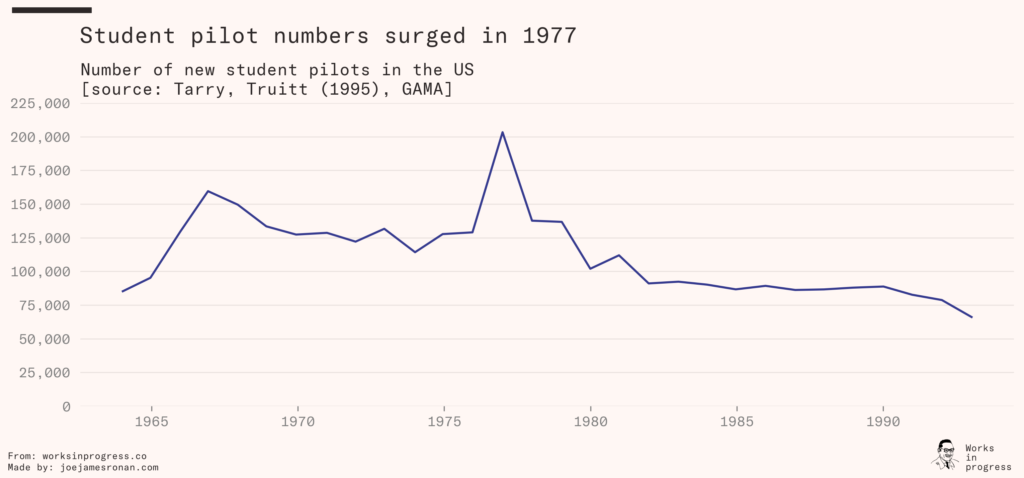

According to the aviation manufacturers, the price increases caused by rising insurance costs resulted in a collapse of new aircraft shipments. Sales of single-engine piston aircraft declined by more than 90 percent between 1978 and 1991. Some pilots opted to purchase much cheaper used aircraft rather than expensive new ones, while others purchased ‘kitplanes’, planes that were bought as a kit of parts and assembled by the purchaser (and thus resistant to product liability claims against the manufacturer).

Of the ‘big 3’ general aviation manufacturers (Cessna, Beech, and Piper), Cessna ceased sales of single-engine piston-powered aircraft in 1986, and Piper declared bankruptcy. As Storrs Hall states:

“[Cessna] cited product liability as the cause for their demise. The corporation’s CEO, Russ Meyer, said that production would resume if a more favorable product liability environment were to develop. Piper, the Ford to Cessna’s Chevy among private plane manufacturers, went bankrupt in 1991.”

(Critics point out that, since liability insurance covers claims from every plane still in use, ‘cost per plane delivered’ is in some ways a deceptive metric. Since most of the insurance cost will likely be due to planes sold in previous years, it doesn’t tell you much about actual costs incurred. If there are 50,000 Cessnas in existence, and sales drop from 5,000 per year to 500 per year, total insurance costs might not change much – the next year, there will be 50,500 planes to insure rather than 50,000. But the cost per plane delivered will nevertheless increase tenfold.)

Alternative explanations for general aviation’s collapse

The general aviation industry framed liability costs as ‘the dominant, if not exclusive,�’ cause of their collapse. But it’s worth noting that this story isn’t universally accepted. Critics point out that there were many other factors working against the industry.

For one, the increased energy prices after the second oil shock in 1979, followed by the recession in the early 1980s, would be expected to decrease the attractiveness of personal aircraft – a similar collapse in units shipped followed the recession of 1970, though, as Storrs Hall notes, the industry had previously bounced back, suggesting ‘that the later collapse was a systemic change and not a cyclic downturn’.

But an industry bounce-back is far from guaranteed, especially for what amounts to an expensive, fuel-hungry luxury good. We see a similar sustained post-1979 decline in the sales of boats and recreational vehicles (RVs), for instance. Consumer spending on private boats decreased 66 percent between 1979 and 1982, recovered in 1985, then dropped again, and didn’t reach its previous high until 1999. RV shipments decreased by 75 percent between 1978 and 1980, and didn’t recover to their previous levels until 2016.

And the double impact of energy costs and recession fits the timeline slightly better – general aviation shipments declined sharply starting in 1980, but the liability insurance spike didn’t occur until several years later. From the late 1970s through the early 1980s, product liability insurance, according to the DOJ’s tort liability working group, was ‘readily available at declining cost’.

Of course, since Storrs Hall lays much of the blame for our stagnation on ‘ergophobia’ and failure to adopt nuclear power and other technologies of energy abundance, in some ways an energy-crisis-fueled industry collapse only proves his broader point. But it does point to larger factors at work besides just liability costs.

Another theory behind new planes being less attractive is that the late 1970s production volumes were largely driven by anticipation of increased demand that failed to materialize. This anticipation, in turn, was caused by a mid-seventies spike in student pilots, supposedly caused by concern that the GI Bill might rescind funding for civilian flight training. But the spike quickly reverted, and (so the story goes) the increased demand failed to materialize.

Thus, the huge numbers of planes produced in the late 1970s meant huge numbers of cheap used planes just a few years later. This, combined with a change in tax treatment (which effectively raised the price for new planes by about 10 percent), made used planes much more attractive. The added costs from rising insurance premiums would have only added to these issues. As one pilot described it:

“[In the 1970s] purchasing a new airplane qualified for a whopping investment tax credit that came right off the bottom line of my tax return. It also qualified for first-year ‘bonus’ depreciation and double-declining balance accelerated depreciation. When you figured all the tax benefits, buying a new airplane cost no more than buying a clean, late-model used one.”

All that changed during the early Reagan years when the tax code was overhauled. The ITC vanished. Bonus depreciation vanished. Accelerated depreciation vanished. New aircraft were more expensive. Clean, late-model used aircraft were more plentiful than ever, and cost a small fraction of what the factory wanted for a new one. Justifying the purchase of a new airplane became very difficult unless you simply had more cash than you knew what to do with. Which was never my situation.

So when I decided to step up to my first twin in the mid-80s, I bought a used airplane for the first time in my life. And so, apparently, did everybody else. The rest, as they say, is history.

This would not be the first time new aircraft sales and new pilot numbersstarts both collapsed. Storrs Hall briefly mentions the post-WWII flying boom, where general aviation shipments peaked at 35,000 units a year (a number that would never be exceeded – peak general aviation shipments in the 1970s barely reached half that.) This boom was driven, in part, by GI Bill subsidies for flight training – 63 percent of the flight hours in 1947 were from instructional flights. But, partly due to increased government restrictions on flight training reimbursement, this enthusiasm quickly waned. Instructional hours collapsed by 90 percent over the next five years, and general aviation units shipped dropped from 35,000 in 1946 to less than 3,000 in 1952, a decrease of more than 90 percent.

The ‘market glut’ theory suggests that the collapse might have been mitigated if general aviation manufacturers had introduced new planes that were attractive enough that older planes no longer seemed ‘good enough’. This seems to be the sentiment of John Baker, the former president of the Aircraft Owners and Pilots Association (AOPA), in a letter he penned in 1988:

“Product liability judgments are not the cause of the new aircraft shortage in which we find ourselves. It is merely a symptom. The cause of the problem was clearly some unbelievable bad business decisions by the manufacturers 15 to 20 years ago, which is compounded by some lousy products. If the industry was annually producing the 20–25,000 quality products at an affordable price that the marketplace would absorb, then the per-unit product liability insurance costs would not be significantly greater than they were in the mid-70s.”

The 1990s and beyond

As Storrs Hall states, the general aviation industry essentially never recovered from this collapse. Though both Cessna and Piper would return to the market, general aviation is a shadow of what it once was, shipping a tiny number of exorbitantly expensive planes that have changed little in four decades:

“The fact remains that a new Cessna Skyhawk cost $25,000 in 1980 and $300,000 today . . . As I write, only 700 small private airplanes are shipped each year.”

Not even the passage of the General Aviation Revitalization Act (GARA) in 1994, which limited liability to aircraft 18 years or younger, was able to overcome a culture that demanded shielding from all possible risks. Storrs Hall continues:

“If, in 1900, Orville and Wilbur Wright had faced the regulatory and legal environment that we have now, the Flyer would never have gotten off the ground.”

As Wildavsky notes in Searching for Safety, this demand is antithetical to innovation – the risks of new technology and capabilities are inseparably bound with the benefits they bring.

However, we see a somewhat different, more complex trajectory for product liability.

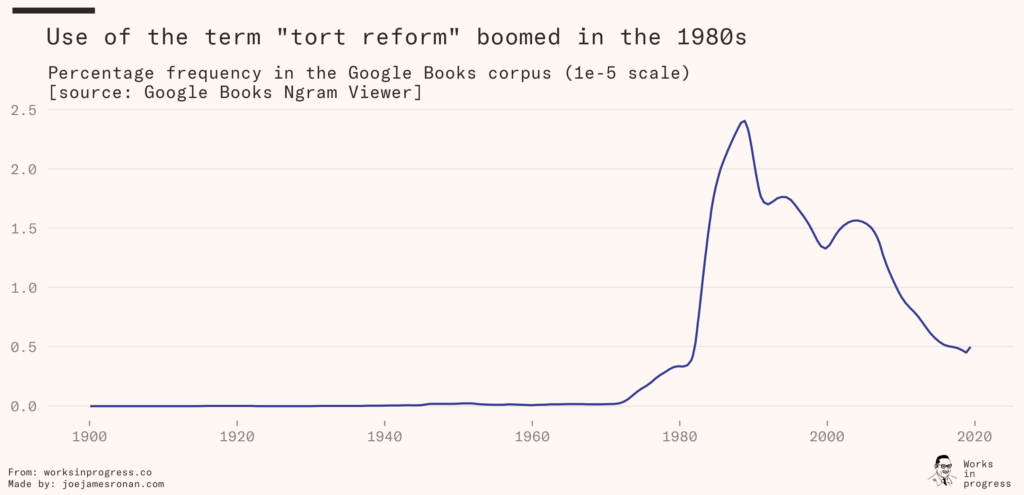

By the late 1980s, the liability situation had reached the level of national crisis, spawning books, newspaper and magazine articles, government reports, research studies, and congressional hearings. ‘Tort reform’ became the cause du jour, and as business-backed organizations like the American Tort Reform Association, the Institute for Legal Reform, and Citizens Against Lawsuit Abuse sprang up, the movement gained steam.

Nearly every state passed some type of liability reform, aimed at capping potential damages. Courts, which had previously interpreted liability laws in increasingly expansive ways, began to be more conservative in their interpretations.

But the greatest impact seems to have come from changing perceptions about the role of litigation (in part fueled by PR campaigns funded by tort reform organizations). Juries became ‘more pro-defense, more anti-plaintiff’. Insurance companies became more willing to litigate, and lawyers became pickier about the cases they took on. Between 1993 and 2015, tort lawsuits filed per capita declined by 80 percent.

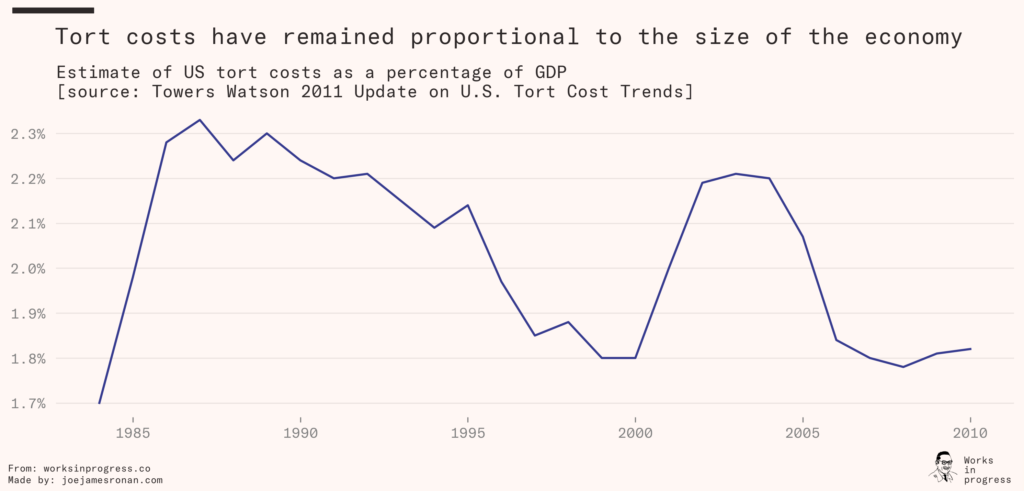

But despite this change, the impact on money spent on tort litigation seems to have been somewhat modest. After rising in the late 1980s, costs as a fraction of total GDP declined slightly, but have since fluctuated between about 1.75 percent and 2.35 percent – roughly three to four times the rate in the 1950s.

Product liability insurance rates also peaked in the late 1980s, though have similarly remained well above their pre-1970s levels.

And liability concerns continue to dog the general aviation industry, with manufacturers continuing to pay tens of millions in settlements and jury awards – in one 2001 case against Cessna, a jury awarded the plaintiff $480 million for injuries sustained in a crash that occurred in 1989, in a plane that was built in 1965.

So despite an apparent decrease in litigiousness, it seem as if we’re still living in a world of high tort costs and liability insurance rates, a world where we’ve taken, as Storrs Hall states, ‘more than a million of the country’s most talented and motivated people and [put] them to work making arguments and filing briefs instead of inventing, developing, and manufacturing.’

Planes, claims, and automobiles

But it’s worth probing the contours of that world a little closer. In particular, it’s worth considering the automobile, which is the path Storrs Hall hoped aviation would follow – starting out as a risky product for daredevils, and transitioning to a safe, convenient, and ubiquitous mode of transportation.

But with cars, this transition was accompanied by a massive increase in the costs of liability litigation and insurance. Between 1920 and 1970, automobile liability payouts increased by 11,000 percent in real terms, ten times more than the number of cars sold, largely preceding the ‘liability explosion’ of the 1970s and 1980s (though auto liability costs also increased during this period.) As of 2016 auto liability tort costs made up 37 percent of all tort costs (the largest single category by far), and as of 2008 spending on auto insurance was twice that of workers’ comp insurance, five times medical malpractice insurance, and seven times product liability insurance. The costs of liability, then, are almost entirely driven by the very product Storrs Hall hopes to emulate.

Given that general aviation is, and always has been, more dangerous on a per-mile basis than car transportation (the current fatality rate per mile for general aviation is about ten times that of car travel), a world where private planes are ubiquitous is likely one where liability and insurance costs are much higher than they are now, even in the absence of any sort of product liability or litigation against manufacturers.

Is this simply another manifestation of a society-wide decline in risk tolerance? Possibly (though the timing throws a bit of a wrench into Storrs Hall’s narrative.) But it’s also just a reflection of the amount that Americans drive (about twice as much as the next closest country), and the fact that auto insurance must often covers the high costs of US medical care. Given Storrs Hall’s focus on the importance of abundant energy, it’s perhaps useful to think of liability as part of the cost of energy abundance – a kind of tax we pay on the inevitable consequences of being able to easily accelerate thousands of pounds of vehicle to enormous speeds.

More broadly, Storrs Hall is correct that liability and insurance costs are a reflection of the sort of society we live in. It’s a society with an increasing aversion to risk, but it’s also one that’s increasingly complex and requires more and more specialized expertise to manage, one where we try to force the market to provide a social safety net (if often inefficiently), one with ever-rising costs of medical treatment, and one that, for better or worse, uses huge numbers of cars.